What Gold Tells Us About Housing

The U.S. housing industry is in a state of decline. The three year housing crisis has spawned several ill effects. Home Depot recently announced an unprecedented closure of 15 flagship stores. Home builder stocks have been cut in half. Foreclosures and price declines on existing housing stock are at all-time highs. There is certainly no shortage of theories these days explaining what caused the housing bust, or when the housing market will recover. Most tend to blame unscrupulous mortgage brokers, lax lenders, overzealous builders and of course, Alan Greenspan’s ‘loose’ monetary policy from 2001 – 2004.

Although these ideas about the causes of the housing crisis have some merit, they are generally rooted in "bubble" theory, which is conventional-speak for not being able to explain the "bubble" to begin with. Bubble theories usually abound from a misreading or an incorrect interpretation of various market signals. Furthermore, most analysis of the crisis overlooks one important signal altogether: gold. If one wants to understand the current housing morass, look to the price of gold and its movements.

First, a digression as to why Gold is important. Gold is the most important market signal of all because it defines the price of a currency, including the dollar, and the value of currencies relative to others. Gold is the best measure of currencies because of the intrinsic qualities within it.

For one, we know where gold is, even in the ground. It is also virtually indestructible. New gold is generally consumed, leaving the existing stock static. Furthermore, as Paul Hoffmeister of Bretton Woods Research points out, gold is the one commodity that has never backwardized, i.e. the spot price never exceeds the long price. What this tells us is that gold is not susceptible to short term supply/demand pressures, thereby maintaining stability relative to currencies. What is critical to remember is that movements in the gold price indicate either dollar strength or dollar weakness. A stable gold price is ideal because it means that monetary policy is neither deflationary or inflationary.

The uniqueness of gold as a market indicator can be useful in analyzing the housing market, other fundamentals aside. The two most watched housing market indicators are new housing starts and existing home sales. The evidence suggests that the price of gold can shed light on the prospects for both.

Homebuilders and Housing Starts

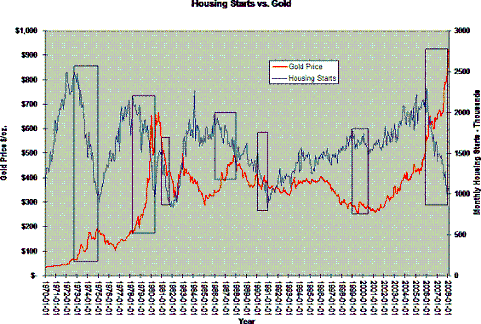

With the current housing crisis in mind, we can look to single family home starts since 1970. When tracked against the spot price of gold, a rather startling trend emerges. Housing starts tend to rise or fall based on divergences in the gold price. When the dollar/gold price changes dramatically, i.e. monetary policy becomes inflationary or deflationary, housing starts fall in tandem.

What the data evidences is that the Fed’s monetary policy has engineered seven slowdowns in housing starts since 1971. Five slowdowns were the result of inflationary pressures indicated in the gold price. Two were the result of deflationary pressures, particularly the 1980-1982 episode that liquidated many home builders. Housing tends to do well once monetary policy is oriented correctly, i.e. monetary policy becomes disinflationary or reflationary.

Particularly apparent is the long sustained bull market in housing starts from 1991-2005. This period coincided with the Fed’s best monetary policy management, which generally stabilized the dollar against gold and wrung residual inflation from the 1970s out of the system. Of course, an added benefit to dollar stability was lower long term rates, increasing affordability for newer and better housing.

The current housing problems began in late 2005 when the gold price really started to rise, reflecting accelerating inflationary pressures. While gold has been increasing steadily since 2001 (and the dollar weakening) it is apparent that the market gave up on the Fed’s lack of dollar management in 2005. Thus the subsequent rapid decline in housing starts was a logical response to the lack of direction from the Fed regarding the dollar. This is the trend that is further evidenced in inflationary periods in 1972-1975, 1978-1979, 1986-1988, and 1990-1991.

This is not to say that other factors such as sudden changes in fiscal and regulatory policy can’t have ill effects on housing starts. But the evidence suggests that new housing starts thrive when gold, and thus the dollar, are stable.

Existing Homes and Falling Prices

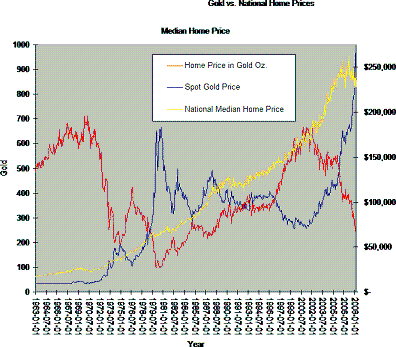

Next, we look to the Census Bureau’s reported national median home price. Although nominal prices have risen over time, real prices - as defined in ounces of gold - declined rather sharply beginning in 1971 and rose very slowly subsequently to the dollar devaluation of the 1970s.

Keeping the recent housing boom in perspective, housing values in real terms peaked in 2001, albeit slightly lower than where they were in the 1960s. The trend in increasing real values as measured in gold from 1980 onward had simply reversed what the inflation of the 1970s did to real values that peaked in the late 1960s. So the perception that housing keeps pace with inflation is misleading. Instead, nominal prices serve to minimize losses in real terms at best.

While aggressive underwriting fueling unprecedented home buying generally gets the blame for the fall in existing home prices, blame truly lies at the feet of the government’s inflationary monetary policy. The current decline in nominal prices is the market’s way of bringing nominal prices in line with housing’s real value in gold. Home prices are adjusting to the Fed and Treasury’s wanton neglect of the dollar.

Where Does Housing Go From Here?

In short, no one really knows for sure when existing housing prices will recover or when housing starts will resume at a healthy clip, but an eye on the gold price should help us monitor the situation. Nationally, nominal housing is 13% off its March 2007 high, and is currently worth in real terms 231 gold ounces. This of course will vary by individual market, with the coastal areas more likely to have steeper fall-off in prices. But what is really scary is that the housing to gold ratio could still fall further judging by historical evidence.

Current nominal housing prices in gold ounces have yet to reach the February 1980 bottom price of 101 gold ounces, implying a nominal housing price of $90,000. Will housing fall that far? Highly unlikely, due to a more ‘moderate’ devaluation of the dollar in gold terms, lower taxes on capital in general, and a tax code biased in favor of home ownership. But this is nonetheless illustrative of how far nominal housing prices can decline to equate to the historical precedent in gold terms. The bottom in real values in 1980 was against an implied 460% devaluation in the dollar gold price from 1977-1980, as compared with a 250% devaluation in the dollar gold price from 2005-2008. Of course, this presumption assumes that the Fed and Treasury correct wayward monetary policy.

In the current crisis, it is impossible that housing will recover without a correction of the slide in the dollar, of which said weakness is demonstrated by the rise in gold to over $900/oz. This is because participants in the housing market, home buyers, builders, and lenders, will not make investments until they can be assured the Fed won’t devalue the dollar again.

In spite of policymakers likely to make the situation worse in the coming weeks trying to fix the problem, the solution is really quite simple. Fix the dollar to gold. It is not even necessary to fix the dollar to a lower five-year average gold price. What is important is to fix to a price and stick to it. Roosevelt devalued the dollar against gold in 1935, but the price was fixed nonetheless.

Maintaining a dollar/gold price would allow homebuilders to commence building, homeowners would no longer be inclined to walk away from their homes due to falling prices, and lenders would not be awash in red ink from mark-to-market losses and foreclosures. We would also hear a lot less about Home Depot closing flagship stores, depressed homebuilder stocks, and those ever-increasing foreclosure rates.