Happy Holidays From the Saudis and Shale Oil

While Americans were enjoying their thanksgiving feast this year, they received an extra blessing from two sources: the shale (cheaper) oil revolution and Saudi Arabia. Due to pressure from a surge of shale oil supply coupled with weaker global demand for energy, oil prices had, by the week before Thanksgiving, dropped about 30 percent from $110 a barrel last summer to $78 a barrel. Thanksgiving coincided with OPEC's price setting meeting at which the Saudi refusal to cut production (restrict supply to boost the price of oil) has so far cut the price by another $8-$10 a barrel.

Be grateful

Of course there are no guarantees that oil prices will stay at current levels indeed they could rise or fall. But the current price of about $70 per barrel versus the previous average of about $110 a barrel represents a huge, and largely unexpected, 40 percent cut in American energy costs which run about $400 billion annually. That is equivalent to a tax cut with no strings attached of about $160 billion, enough to finance over a quarter of the roughly $60 billion worth of holiday spending expected this year.

In broader terms, cheaper oil is currently the equivalent of a tax cut equal to almost a full percentage point of US GDP. If oil price stays around current levels, as it may well do given the fortuitous combination of extra supply from shale and Saudi largess and weaker global oil demand (stagnating growth is evident in China, Japan, Europe, and emerging markets - about half of the global economy), the windfall of cheaper energy may boost 2015 growth by about 50 percent, from the current 2 percent average up to 3 percent. That is truly great news, especially coming as it does amidst a flurry of negative news tied to elevated uncertainty about tensions in the Middle East, Ukraine, and greater Asia. Intensifying China/Japan bickering about who is in charge in the Pacific region is especially problematic.

Caveats

Not all are winners when oil prices drop. Oil consumers gain while oil producers lose. Oil producers faced with lower oil prices expect to earn less profits, and they reduce or cease production if the lower prices don't cover production cost. Oil producers also may invest less in maintenance and expansion of oil production facilities in the face of lower oil prices, thereby placing some modest drag on GDP. That drag amounts to about 0.1 percentage points of GDP based on estimates by Jan Hatzius at Goldman Sachs ("The GDP growth effects of increased energy supply," Goldman Sachs US Daily, July 29, 2014).

Some estimates of the net boost to US GDP growth from cheaper energy specifically those by the Federal Reserve, set the positive effects lower than our estimate of about 1 percentage point. Fed estimates, derived from its somewhat unreliable large scale FRB/US macroeconomic model, put the net boost of a 40 percent oil price cut at about 0.5 percentage points of GDP.

The Fed's model is notoriously prone to underestimate the impact upon US growth of exogenous shocks, like the 40 percent drop in oil prices over just a few months, especially when the shocks emanate from abroad. One of the reasons for a lower oil price, sharply increased shale oil supplies from the US, is domestic, while weaker growth of oil demand and the new weakness of the OPEC monopoly are exogenous and originate outside of the US. Suffice is to say that a sharp 40 percent drop in oil prices is good news for the US economy worth somewhere between 0.5 and 1.0 percentage points of extra GDP growth spread over about 18 months.

The long run

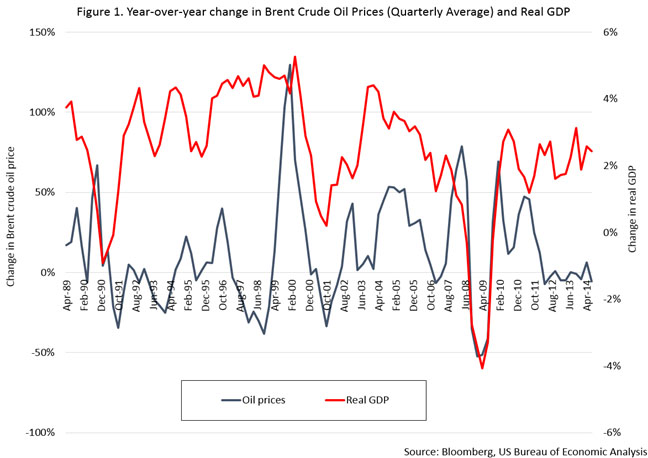

Putting the current period into a longer run context, Figure 1 displays year-over-year growth rates of real GDP and Brent crude oil prices since 1989. The period since 2008 is perhaps the most interesting. While GDP growth has returned to around a 2 percent pace, year-over-year oil price increases have slowed steadily before turning outright negative by the third quarter of this year. The combination of larger shale oil supplies and weaker global growth caused oil inflation to drop relative to GDP growth by about 2012. That trend has intensified during 2014 by the additional weakness in China and most recently by Saudi Arabia's efforts to drive down oil prices by maintaining oil output in the face of weaker demand. Oil price disinflation is more persistent relative to growth than it has been since the 1990's suggesting that more shale oil supply and the weakness of global demand are contributing to underlying weakness in commodity prices.

Maximizing the growth bonus from cheaper oil

The positive impact of cheaper oil represents a great opportunity for the US to help the global economy break out of its post-financial crisis doldrums. This is especially true given the global weakness of demand that is pushing the world toward outright deflation. In the case of the US, nearly an extra percentage point of growth in 2015 could mean a sustained 3 percent growth pace, enough to boost employment sufficiently to lower the unemployment rate to below the 5 to 5.5 percentage point range currently expected.

Full, sustained restoration of US growth to pre-crisis levels of 3 percent could be achieved by combining with the fortuitous boost from lower energy price, payroll and income tax rate cuts of about $300 billion, as outlined in my Economic Outlook last month. The new Republican Congress should not reduce pressure for lower tax rates even if the lower oil price bonus temporarily boosts 2015 growth to 3 percent or above. They should push harder for the tax rate cuts that could provide the basis for a sustained liftoff of the US economy that has been sought since the 2008 financial crisis. That liftoff could help the global economy, currently languishing, back to sustained growth.

A combination of good luck (lower oil prices) and good policy (lower income and payroll tax rates) can move the US back onto its long run 3 percent plus growth path. That might set the stage for a renewed decade of higher global growth.