Coming Up For Air: American Finances - 4/30/10

| One upside to The Great Recession has been a notable shift in how most people view their finances. While just a few years ago it was OK to support an otherwise unaffordable lifestyle with credit cards and home equity loans, these days Americans are more determined than ever to live within their means. More |

Who Americans Trust - 4/30/10

| A recent Pew Center poll drew attention because it found that few Americans trust government. But what the media overlooked was who garnered the most trust from Americans. Hint: It wasn't the media. More |

Home Ownership: A 10 Year Low - 4/27/10

| According to the Census Bureau, the U.S. homeownership rate fell to 67.1 percent in the first quarter of 2010, the lowest rate since the first quarter of 2000, exactly ten years ago (see chart below). Compared to the peak of 69.2 percent in the second quarter of 2004, the homeownership rate has fallen by more than two full percentage points in the last six years. More |

Health Costs and the Deficit - 4/27/10

| If we could get our healthcare costs in line with those in the UK or Canada, we’d actually be running a budget surplus pretty soon. More |

The VAT and Economic Growth - 4/23/10

| Taxes on capital income generate the most distortions. Taxes on consumption generate the least distortions. More |

Update: The Inflation Debate - 4/23/10

| The core ingredient of inflation (producer or consumer) is money growth, and there just doesn't seem to be enough M2 money growth to generate 1970s-era inflation. More |

The Housing Price Decline - 4/21/10

| We have, I think, an excessive degree of concern right now about home ownership and its role in the economy... those who argue that housing prices are now at the point of a bubble seem to me to be missing a very important point... This is not the dot-com situation... you're not going to see the collapse that you see when people talk about... More |

TARP Calculator - 4/20/10

| The $700 billion TARP fund was created in October 2008 to enable the Treasury Secretary to purchase or insure troubled assets, but ended up being used to bail out banks and auto makers. In its Preliminary Analysis of the President's Fiscal 2011 Budget, the CBO revised its net 10-year cost estimate for TARP to $109 billion over the life of the program. Most of that cost is projected to stem from the assistance to the... More |

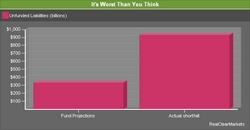

Those Unfunded Teacher Pension Plans - 4/16/10

| According to their own financial statements, the 59 pension plans covering most public school teachers in the United States are underfunded by $332 billion. However, this figure is overly optimistic. The plans use aggressive "discounting" assumptions (the calculations that determine how much cash is needed today to pay an obligation far in the future) to reduce their calculated liabilities. More |

Tax Rates Over the Years - 4/16/10

| The highest marginal income tax rate in 1913 was only 7%, but it only took Congress five years to raise the highest rate to 77% in 1918, and eventually to rates above 90% in the 1940s and 1950s (see chart above). More |

Are Payroll Taxes Regressive? - 4/14/10

| Social Security taxes fund a thing known as Social Security benefits. Analysts of this system consider them together in order to determine whether the program is or isn’t progressive. More |

Debt and GDP Growth - 4/14/10

| We examine the experience of forty four countries spanning up to two centuries of data on central government debt, inflation and growth. Our main finding is that across both advanced countries and emerging markets, high debt/GDP levels (90 percent and above) are associated with notably lower growth outcomes. More |

The VAT Tax Around the World - 4/13/10

| Currently the United States is the only country in the OECD that does not have a Value Added Tax. Some in the American left believe that the US should introduce a federal Value Added Tax. The pro-market side argues that a VAT leads to an expansion of government. Much of the growth of the welfare state in Europe was financed with the VAT. Between 1970-2007 the VAT increased from 2.8% of GDP... More |

Why Did Investment Fall During the Recession? - 4/09/10

| One view is that investment fell largely because labor fell (and labor and capital are complements). For example, if fewer people are to be working, it's time to slow down the building of new office buildings and factories in which they would work. An alternative view is that businesses were actually hungry for loans to finance new investment, but that banks were in such a chaos that loans were not available. What do the numbers... More |

Should You Drop Your Health Insurance? - 4/09/10

| The recently passed health reform legislation is intended to provide health insurance coverage to all Americans, regardless of their current state of health. Unfortunately, the new law provides powerful incentives that can encourage healthy individuals to drop their current health insurance coverage altogether. But would dropping insurance coverage actually make sense for healthy individuals? To find out, we've built a tool to... More |

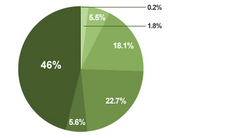

Who Pays Income Taxes? - 4/08/10

| In recent years, credits for low- and middle-income families have grown so much that a family of four making as much as $50,000 will owe no federal income tax for 2009, as long as there are two children younger than 17. More |

Americans Still Worried About Banks - 4/08/10

| Even as the economy, and the financial sector, have shown rapid recovery, Americans’ confidence in banks remains at a historic low, according to Gallup. More |

The Risks in Household Debt - 4/08/10

| What differentiates this recovery from every other cycle since 1929 is the lingering debt deflationary pressures. There is a very large overhang of U.S. household financial leverage that’s going down one of two ways: the easy way, through nominal income growth, or the hard way, by default. Unfortunately, the hard way is rearing its ugly head. More |

Public Unions and State Debt - 4/05/10

| There are hundreds of reasons why states accrue debt. In some cases, it has to do with special programs they pursue. (See RomneyCare.) In others, it has to do with their method of taxation. But the states with the highest per-capita debt all have something in common: Robust public-sector unions. More |

Unions: The Convergence - 4/02/10

| Percentage of union members working for federal, state or local government? More |

Low Tax Canada? - 4/01/10

| Canada's relatively low corporate taxes have helped to make this country one of the best places in the world for companies to set up shop. Canada ranks second among 10 key countries as a cost-effective place to do business, and relatively low taxes are one of the main factors. More |