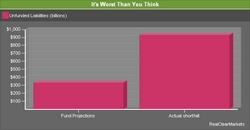

Those Unfunded Teacher Pension Plans

According to their own financial statements, the 59 pension plans covering most public school teachers in the United States are underfunded by $332 billion. However, this figure is overly optimistic. The plans use aggressive "discounting" assumptions (the calculations that determine how much cash is needed today to pay an obligation far in the future) to reduce their calculated liabilities.

full articleRecent By The Numbers Archives

Tax Rates Over the Years - Carpe Diem

The highest marginal income tax rate in 1913 was only 7%, but it only took Congress five years to...

Are Payroll Taxes Regressive? - Enterprise Blog

Social Security taxes fund a thing known as Social Security benefits. Analysts of this system...

Debt and GDP Growth - American Thinker

We examine the experience of forty four countries spanning up to two centuries of data on central...

The VAT Tax Around the World - Super-Economy Blog

Currently the United States is the only country in the OECD that does not have a Value Added Tax....