How to Return to a Gold Standard

Two weeks ago the leaders of the world met for what many referred to as Bretton Woods II. What transpired was one of the greatest misreads of cause and effect that the policy world has ever seen.

The G20 heads ostensibly got together to try and fix all the financial ills that have befallen us since the U.S broke the dollar’s link to gold in 1971. But judging by the news that leaked out, any policy that might result will surely bring more regulatory complexity to a world economy that presently needs less. In short, our leaders know not why we are struggling. The answer lies in a dollar that lacks definition.

The goal of Bretton Woods II should have been to repeat the result achieved during the 1944 confab, which was to link the value of the U.S. dollar to gold. If this should somehow happen going forward, the dollar would take on magnetic qualities for its ability to attract capital from around the world. Of perhaps greater importance, in one year’s time most of the world’s currencies would be linked to the U.S dollar at different ratios. As a result, currencies the world over would have a stable gold definition.

But didn’t the first Bretton Woods fail? And if we re-linked the dollar to gold, wouldn’t we be setting ourselves up for failure again? The great thing about history is that it can be studied to understand why we achieved a result that we did not expect. It has been known for quite some time why the original Bretton Woods system failed; therefore, we can create a new system that fixes those flaws.

The first mistake made under the old system had to do with the U.S. government being given full power to maintain the dollar link at 1/35th of an ounce of gold. This was not considered a flaw in 1944 because at the time, it was seemingly inconceivable that the U.S would decide to break the gold link by inflating in the way it did.

Nevertheless, this is exactly what happened in the mid to late 1960’s. At the core of the original 1944 world dollar standard was a convertibility feature that allowed foreign banks to exchange dollars for physical gold if the U.S started to inflate.

This basic form of convertibility served as an essential signal for U.S. monetary authorities when it came to knowing whether too many or too few dollars were being created. The system worked well for three decades due to the fact that the U.S kept its promise when it came to maintaining the integrity of the dollar-gold link.

With the dollar defined in terms of an historically stable commodity, the United States economy and economies around the world prospered tremendously in the 1950s and ‘60s. However, by the mid ‘60s, monetary authorities stateside began to break their promises with regard to the dollar, which set off a chain reaction throughout the dollar-linked world.

Simply put, the U.S turned on the dollar printing presses and refused to turn them off. And with the world awash in greenbacks, the aforementioned convertibility feature served its market purpose in revealing U.S. monetary error.

In short, by the late ‘60s and early ‘70s there was a marked increase when it came to foreign central bank redemptions of cash for physical gold. The signal to President Richard Nixon’s monetary authorities was that they had over-issued the dollar.

But rather than reduce dollar liquidity, or, restate the U.S.’s commitment to the gold/dollar standard, Nixon advised Fed Chairman Arthur Burns to continue printing money owing to the mistaken belief that money creation itself fostered economic growth. With an election looming, Nixon chose to sever the dollar’s link to gold on August 15, 1971. Nixon’s action devalued the U.S dollar and the inflation of the 1970’s began.

Fast forward to today, two issues need to be dealt with if the U.S wants to return to a commodity standard whereby the dollar is linked to gold. The first has to do with what is the appropriate gold-price target. Given the certain deflation that would result from a $35 gold fix, returning to the exact Bretton Woods standard would be highly inappropriate.

The second issue concerns how a new Bretton Woods-style monetary fix could avoid the mistakes of the late ‘60s and ‘70s where the lead country (the U.S.) over-issues the standard currency. Absent a credible commitment to maintaining a sound currency, any new system would quickly come undone.

What is the appropriate gold target price?

Long-term gold-price averages were calculated over different lengths of time below. The averages are the monthly mean price of gold using the London PM fix. The idea here is to let this market data tell us what the optimal gold price should be.

The first thing that becomes apparent when looking at these long-term averages is that the recent average prices are very high compared to the longer-dated ones. The second notable feature is the cluster of longer-term averages that includes the 15-year through 30-year averages, which all are in the $400/oz range. The third aspect is that the further we go out in time, the lower the mean price of gold.

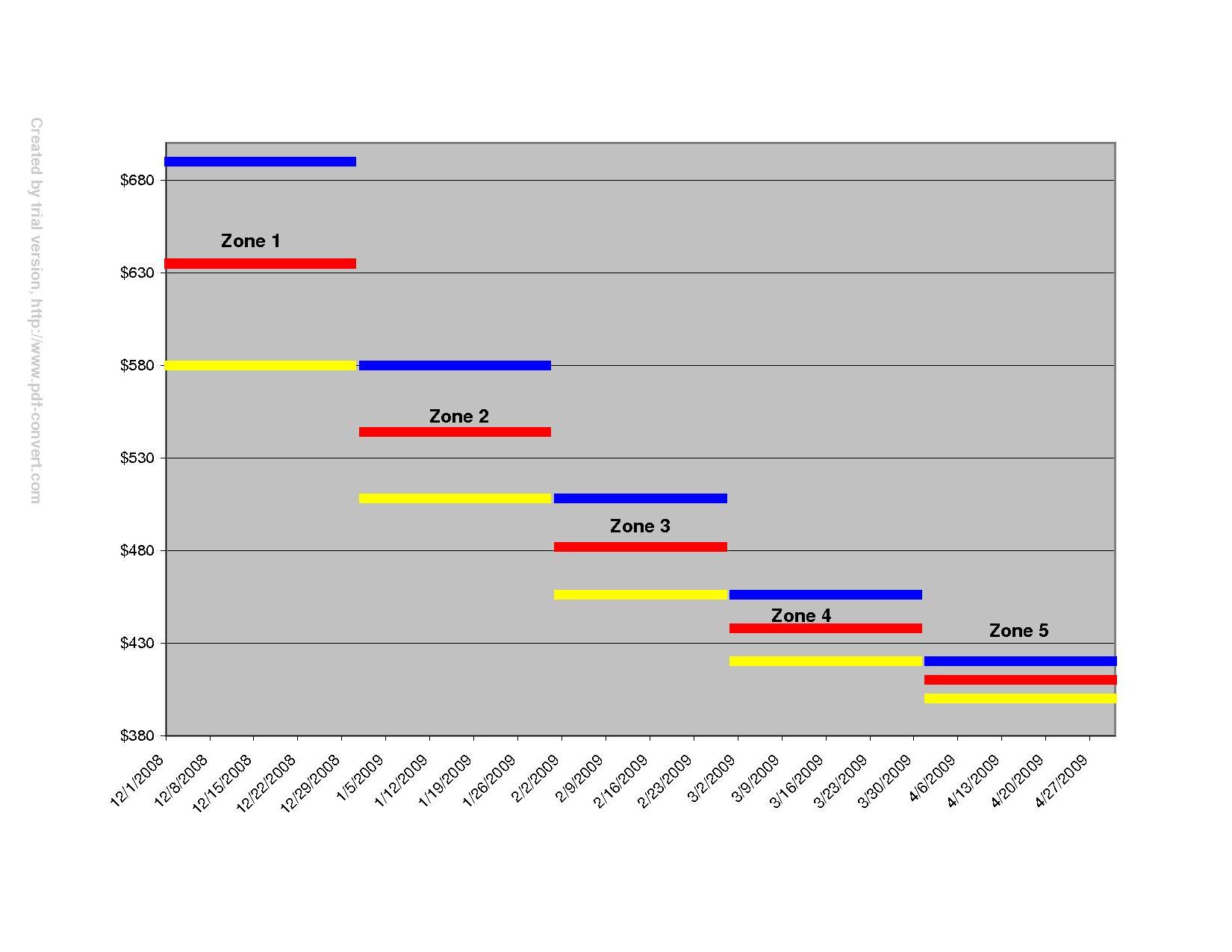

Due to the volatility of floating exchange rates, returning to a specific optimum gold target will need to be a process, as opposed to the Treasury or Fed simply picking a gold price. The process will involve the utilization of longer-term averages to set up various stabilization zones. The zones will allow the price of gold to drift down and therefore allow the value of the dollar to increase. You can create a downward staircase approach in setting up the stabilization zones because of the sequential drop in the mean prices of gold.

As the above chart shows, each zone consists of the long-term averages. The high price for each zone is the shortest average in terms of time. The low price of each zone is a longer-term average, and therefore lower in price. To create symmetry a middle-price target is created. When two averages are very similar (8-year and 9-year) the longer dated average is used.

The Fed would target the middle price of each zone via open market operations. The price would float between the high and low end of each zone. If the gold price hits the high or low end of the band, then the Fed would act by driving the price back to the middle target price. Each stabilization zone would last one month.

To start this process, the Fed would state its intention of driving the gold price down to $635. This is exactly where the price will open because no one would be stupid enough to fight the Fed.

The process of setting the first trade as the middle price of each zone and letting the price float after will continue until the fifth zone is reached. If you start with the first trade in December, by April of 2009 the U.S would have optimum monetary policy for the first time in 37 years.

The great thing about the long-term mean prices is that they point us in the direction of picking the correct optimum target price. By setting the low end of the fifth zone as the 15-year average, we are also bringing in all the contracts created (and still in existence) over the last 30-years, because all mean prices between 15 and 30 years are $400 oz. This process would respect all the contracts set in dollars over the past 30 years.

Eventually the fifth zone would become permanent future monetary policy and gold prices would fluctuate between $420 and $400, with a middle target of $410. As you move from the first zone to the fifth zone, the volatility also sequentially falls. This means future gold volatility would range between 0% and 2.5%.

The result of eliminating monetary errors is that the wages that lag inflation would catch up to the ever-increasing prices that factor into daily living. Once this benefit is realized, the American people would act as a check on any FOMC seeking to impose monetary errors of inflation and deflation on the public’s wages and business contracts.

Stable monetary policy would also increase the forecasting ability of businesses. Prices often change due to monetary error, and when they do, false signals are sent to the marketplace, which exacerbates the business cycle. As time goes on, forecasting models will increase in accuracy: therefore, the business community will also act as a check on Fed activity when it comes to the dollar.

The Fed would become fully transparent by posting its daily open market operations on its website. Ultimately, these checks and balances on the Fed would get stronger as time goes on, thus making monetary errors a thing of the past.