Why Bill Ackman Will Be Proven Right On Herbalife Soon

Bill Ackman tends to be right more often than he is wrong. Over the past decade, he and his team have earned over $13 billion in profits by acting on their best investment ideas. These actions have gained Ackman fame for his heroic actions that enhance market knowledge, but also criticism. Yet one thing is for certain, Ackman and his team at Pershing Square definitely do their homework.

In fact, they do much of the homework that the regulators are either too busy, or too naive to do themselves. The best example of this is well documented in the book, Confidence Game by Christine Richard, which details his volatile, but successful campaign against bond insurer MBIA. At first, his thesis was met with incredulity, as very few people believed him. Several long and stressful years later, the facts revealed that Ackman was right. It takes time for people to learn the truth...

Over the last couple of years, Ackman has learned more about the true details of global giant Herbalife than any other human on the planet. He made this clear in late 2012, when he publicly announced Herbalife was a giant pyramid scheme, and that he had placed a massive wager on its downfall. That's when things got interesting. An avalanche of well-known investors came out with public comments revealing angst, anger, and even resentment. As the drama unfolded, some of the industry's biggest heavyweights got involved, including George Soros, Dan Loeb, and Carl Icahn.

"I appreciate Bill, that you called me a great investor. Thank you for that. Unfortunately, I can't say the same for you." - Carl Icahn

But did they get involved for professional reasons (they liked Herbalife's business potential), or for reasons more personal in nature (resentment toward Ackman and the potential to engineer a coordinated short-squeeze)? My money (literally and figuratively) is on the latter as the evidence against Herbalife has mounted, and regulatory probes have ensued. To date, at least six different regulators have announced inquiries into the company's business practices, including the FBI, SEC, DOJ, FTC, and two attorneys general. But unless regulators actually take steps towards shutting the company down, Herbalife will continue to defraud millions of lower-income people. As of this writing, no formal charges have been made.

Fans of Herbalife point to the impressive numbers the company has generated over its long history of surpassing Wall Street's expectations. They also take solace in the lack of regulatory action (so far) against the company. A few bulls have even hung on to hopes that Icahn would take the company private. All of these bulls may soon have their tails between their legs as Herbalife will sink much faster than Wall Street thinks. It seems that some have already seen the writing on the wall as reports have stated that Soros has dumped his shares.

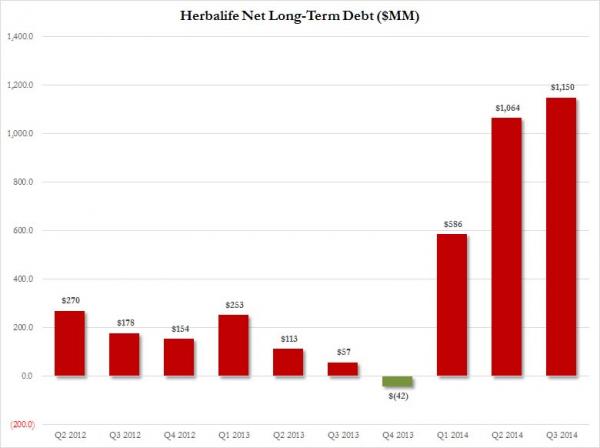

Herbalife's most recent results show that three important things are trending down; sales volume, earnings, and guidance. Yet one thing is trending much higher; the amount of money Herbalife is borrowing as the following chart from ZeroHedge makes very clear.

Debt is not always a bad thing, but one must have the ability to repay, or at least refinance that debt. A quick look at Herbalife's recent balance sheet shows that there is almost $700MM in cash & equivalents. A closer look, however, reveals that less than $200MM (< 30%) is actually available in the United States; a reduction of over 56% compared to the start of the year! The rest of the cash is more or less stuck in different jurisdictions, each with its own potential taxable liability. By its own admission, Herbalife has interest rate risk of approximately $850MM over the next two years. Although the company has a credit facility of over a billion dollars, it will expire in 2016; thus forcing Herbalife to return to the capital markets. The difference this time, is that the interest rates they pay will be much higher as the risk of doing business with Herbalife continues to rise.

This risk is not just financial in nature, it's also a huge legal risk for all stakeholders, especially for those who serve on Herbalife's board of directors. Recently board member and head of the Audit Committee, Leroy Barnes, resigned before his term was set to expire. And not too long before that announcement was made, we learned that fellow board member, Pedro Cardosa, has allegedly been wanted by regulatory authorities in Brazil for years. In fact, over the last eight months, four independent directors have resigned or declined to be renominated to the company's board.

What might they fear? Maybe it's the potential regulatory actions. Maybe it's the stain of being associated with what some deem an illegal pyramid scheme. Or maybe it's the fact that they're literally about to run out of money after borrowing billions for a stock buyback that today looks like a terrible mistake. Arguably Herbalife's biggest mistake is not what it's doing, but rather, what it's not revealing. All the company needs to do is disclose the actual demand for its products outside of the Herbalife network. So far this information has not been forthcoming. Herbalife claims that the number (actual sales outside network) is not relevant. Mr. Ackman claims that number will prove that Herbalife is an illegal pyramid scheme.

They say that time heals all wounds. In Herbalife's case, current shareholders are running out of time fast.