As party conventions approach, their outcomes don’t seem in doubt. Barring a wildcard development, former Vice President Joe Biden will be the presumptive Democratic presidential candidate set to take on incumbent Republican President Donald Trump this fall.

For markets, getting presumptive nominees helps uncertainty fall and typically helps boost stock returns later in election years. Of course, this year the interruptions to business tied to COVID-19 likely outweigh that, at least in the near term. Moreover, the outbreak adds some unique twists to the election. However, in Fisher Investments’ view, falling political uncertainty is still a positive worth noting—even if its power to lift markets is delayed by coronavirus responses—particularly since it may help turbocharge a recovery later in the year if the disruptions to business globally continue to abate.

Falling political uncertainty generally benefits markets by affording investors a clearer view of the likelihood sweeping policy changes materialize. In Fisher Investments’ view, such major shifts often roil stocks, as they create winners and losers, with the latter generally more upset than the former are happy. Early in an election season, when many candidates are competing for their party base’s attention—often via bold policy proposals—political uncertainty is high. With so many contenders and ideas, the vast number of potential outcomes makes it nearly impossible for markets to assign probabilities to them. Then, primaries winnow the field, adding clarity—particularly once presumptive nominees emerge. Markets can assess their policy priorities, which also tend to moderate as nominees tack to the middle in an effort to woo centrists and independents.

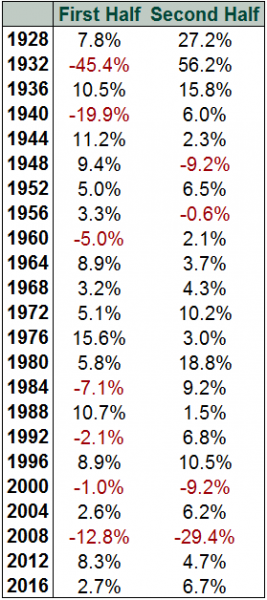

Simultaneously, House and Senate races develop, helping markets anticipate the likely makeup of the next Congress. Gridlock typically dampens legislative risk, whereas one party sweeping the White House and both chambers of Congress usually heightens it. As markets learn more about the likelihood of these and other election scenarios, uncertainty typically falls, helping boost returns as election years progress.

Exhibit: Returns in US Election Years

Source: FactSet, as of 04/08/2020. S&P 500 price returns, 01/03/1928–12/31/2016.

Bear markets are still possible in election years, as the present one demonstrates. Politics isn’t the only stock market driver. But we think the overall pattern is still noteworthy.

This election year, political uncertainty began falling a little earlier than usual. Biden became the presumptive nominee on April 8, when Senator Bernie Sanders ended his presidential bid. Barring an unexpected twist, the contested Democratic convention many had speculated about seems highly unlikely. Biden’s crowning now seems inevitable.

But we think markets have been focused on the coronavirus’ economic fallout thus far, muting politics’ influence. How that plays out could have a bigger impact on returns this year. If business and travel restrictions lift sooner than expected, the positive surprise will likely bolster stocks—and vice versa if that takes longer. That factor will likely be the key to stocks’ course from here.

Although COVID-19 developments probably supersede politics’ impact on stocks in the near term, we think the election can still have a notable influence. If waning coronavirus business interruptions propel stocks to new highs in the next couple of months, falling election uncertainty is likely an added tailwind. If widespread, onerous shelter-in-place orders persist into the year’s second half and the bear market continues, rising political clarity may alleviate the downside somewhat.

Presently, plenty of electoral fog remains. RealClearPolitics’ average of major national polls presently gives Biden a 4.4 percentage point advantage, perhaps reflecting voters’ tendency to view incumbents less favorably during a recession.[i] But we think it is far too early to assign polls much weight now, especially since the economy’s state in November is so up in the air. In our view, the victor will likely be whoever campaigns better in the lead-up to November—unknowable today, particularly given this year’s unique variable of the pandemic. Coronavirus probably impacts the campaigns in several ways—though not clearly to either candidate’s advantage, in our view.

First, restrictions preventing large gatherings and in-person get-out-the-vote efforts likely will likely give the candidate with a better social-media, online, television and direct-mail strategy an early edge. It likely also elevates the importance of large donors and political-action committees, although that doesn’t favor either candidate clearly. Second, how voters perceive the Trump administration’s coronavirus response matters—as in whether they credit or blame federal or state officials’ handling of virus containment efforts. It is too soon to say how this will play out, but it is a matter worth watching.

Finally, as in every election, voter turnout matters a great deal. The coronavirus adds a wrinkle here, too. Will people stay away from polling locations in order to avoid possible crowds or lines, particularly if there is a second wave of coronavirus in the fall? Or will the US imitate South Korea, where turnout for the April 15 parliamentary election was the highest since 1992?[ii] Will more states allow mail-in voting? How might this affect turnout? None of these questions appear answerable today.

Despite all the current unknowns, as the general election progresses, markets likely will start accounting for developments that help them anticipate the eventual outcome. Later polls will likely be one helpful data point. As 2016 showed, even election-eve national polls don’t necessarily reveal the candidate likely to win the Electoral College. Surveys in battleground states like Florida, Michigan and Wisconsin may be more telling, especially as voters’ preferences solidify closer to November. Markets will likely also watch which candidate’s message seems to be resonating more with voters, particularly independents.

Party-base enthusiasm is also key. This heavily influences Congressional races, too, since they frequently hinge on which party is better able to mobilize its base. We didn’t anticipate huge coattails for either presidential candidate pre–coronavirus, and it is premature to assess whether that has changed. But if it does, markets likely will anticipate it.

As stocks digest these and other variables, political uncertainty should fall. While COVID-19 likely will concentrate falling uncertainty’s impact closer to the election—and make it harder to see—we think it will likely exert considerable influence on 2020 market returns.

Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

[i] Source: RealClearPolitics, as of 05/12/2020.

[ii] “South Korea's Ruling Party Wins Election Landslide Amid Coronavirus Outbreak,” Justin McCurry, The Guardian, 04/15/2020.