Americans Want to Own Their Retirement, Not Expand Social Security

Even prior to the Covid-19 recession, Americans worried about having enough income when they retire. Congressional Democrats think the best solution is to expand Social Security benefits, for rich and poor alike, funded with higher taxes on all workers. But a new national survey shows that ordinary Americans have very different ideas.

Personally, I’m skeptical that ordinary Americans face anything like the “retirement crisis” that news articles sometimes warn of. Retirement incomes are at record levels and retirement savings have risen significantly across age, income, educational and racial groups. Nevertheless, it’s perfectly reasonable to think about ways to boost retirement incomes and ensure that every American can enjoy a secure retirement.

One option to raise retirement incomes is the Social Security 2100 Act, which is co-sponsored by 89% of House Democrats. That bill would increase Social Security benefits across the board, financed by gradually increasing the 12.4% Social Security payroll tax rate to 14.8% and phasing out $137,700 cap on wages subject to taxes.

But there’s a second alternative: Americans wishing to increase their retirement incomes could simply save more, via workplace 401(k) plans, Individual Retirement Accounts or other means. To be sure, government can encourage employers to offer retirement plans, such as in 2019’s SECURE Act. Government also can offer tax incentives and programs like the Saver’s Credit to encourage employees to save.

But both expanding Social Security and increased retirement savings present a similar choice: give up money today in order to have more money in retirement.

If there are different reasonable ways of accomplishing the same goal, perhaps the deciding factor should be Americans’ preferences. How do they wish to do it?

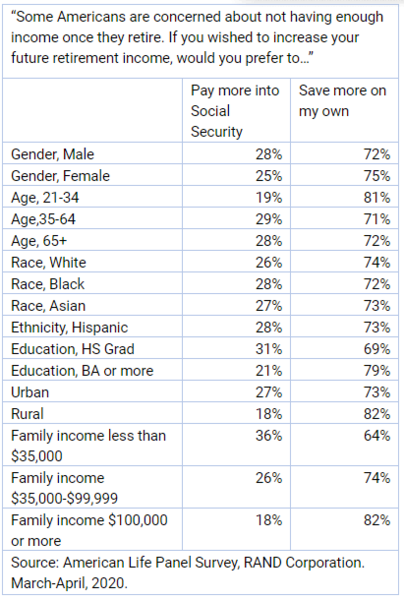

To find out, I commissioned a question in the RAND Corporation’s American Life Panel, an ongoing survey of a representative sample of U.S. households. The survey was fielded in March and April 2020.

It’s easy to skew an opinion poll by how you ask the question. But the question I asked was straightforward and intentionally devoid of framing or spin:

“Some Americans are concerned about not having enough income once they retire. If you wished to increase your future retirement income, would you prefer to: Pay higher Social Security taxes while working and receive a higher Social Security benefit when you retire? Or make higher contributions to a private retirement account such as an IRA or 401(k) and receive higher income from that account when you retire?”

Those are indeed the choices we face and each comes with pros and cons. Nevertheless, the RAND survey results show Americans’ preferences are clear.

Overall, 74% of Americans preferred personal saving versus 26% favoring paying more into Social Security. Whether by gender, race, education, income, or geography, strong majorities of Americans would rather boost their retirement incomes through personal saving than by expanding Social Security. Even among Americans under age 35, supposedly a progressive stronghold, 81% preferred to save more personally over paying more into Social Security. It’s hard to blame them: Social Security has been underfunded since the day these young Americans were born and Congress has gone three decades while doing precisely nothing to fix Social Security’s multi-trillion dollar financing shortfalls.

Yes, retirement accounts aren’t perfect. But innovations such as automatic enrollment, target date funds to automatically rebalance investments, and falling management fees make today’s 401(k)s a better option than in the past. The bigger priority is spreading access to all workers. While I have reservations about state governments’ new auto-IRA retirement plans, these accounts would give every American the option that most seem to favor: saving more for retirement on their own.

None of this is to say that Americans favor getting rid of Social Security. Social Security provides a base of retirement income for all Americans and provides insurance benefits to low-income retirees, the disabled and survivors that a purely savings-based program can’t. But getting rid of Social Security isn’t the question. It’s how we should increase Americans’ ability to maintain a decent standard of living in retirement.

And on that question, Americans’ preferences are clear: if they’re going to put more money aside for retirement, by a three-to-one margin Americans would rather do it in a retirement account they own and control than through an expanded Social Security program.