Editors’ note: As always, Fisher Investments’ political commentary is non-partisan by design. We favor no political party nor any politician and believe markets have no preference, either. We assess political developments solely for their potential economic and market impact.

With the presidential election quickly approaching, discussion abounds about the economic and market impact of a win for Democratic candidate Joe Biden—or a second term of Republican incumbent Donald Trump. Potential tax changes garner extra attention. However, based on Fisher Investments’ research, tax changes have no predetermined impact on stocks—important for investors to keep in mind regardless of November’s winner.

Though neither Biden nor Trump has released a single comprehensive plan, both have proposed tax changes. Biden seeks to roll back parts of 2017’s Tax Cuts and Jobs Act (TCJA), including repealing the income tax reduction for those earning over $400,000 and hiking the corporate income tax rate from 21% to 28%.[i] He has also proposed taxing capital gains at ordinary income rates for people making over $1 million, as well as some environmentally minded policies (e.g., residential energy-efficiency and electric-vehicle tax credits).[ii] Details for Trump’s proposals are a bit more scant. He has mentioned unspecified tax cuts to boost take-home pay—frequently discussing cutting the payroll tax—and tax credits for companies that bring back jobs from China.[iii]

Beyond the particulars, both candidates’ ideas are in line with the type of policies many expect from a Democratic candidate and a Republican candidate. Generally speaking, many ascribe policies calling for higher taxes on businesses and high-earning individuals to Democrats and vice versa to Republicans. (This is a vast oversimplification, but we digress.) Thus, financial headlines have warned investors for months about the market fallout should certain tax changes occur—particularly Biden’s, which are considered less “business friendly.”

In our view, this thinking stems from a faulty premise: that tax cuts are inherently good for businesses and individuals (and therefore stocks) while hikes are automatically bad. The rationale seems logical. If a company has to pay higher taxes, that is theoretically less money to deploy on growth-oriented, profit-boosting endeavors, like business investment or hiring. If this thinking holds water, markets should noticeably rise when taxes decrease and, correspondingly, fall when taxes rise. However, history debunks this conventional wisdom.

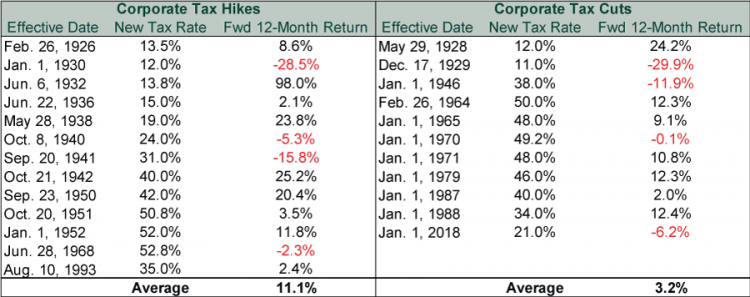

For example, when a corporate tax-rate change occurs, stocks are up more often than down over the next 12 months—regardless of if it is a cut or hike. (See Exhibit 1.) Perhaps counterintuitively, stocks’ average 12-month return is comfortably higher following a corporate tax hike than after a cut.

Exhibit 1: Corporate Tax-Rate Shifts

Source: Tax Policy Center, Global Financial Data and FactSet, as of 09/10/2020. S&P 500 price returns for the periods indicated.

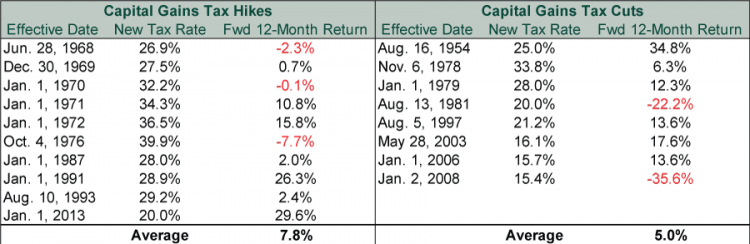

It is a similar story with capital gains taxes, which are levies on selling a capital asset (e.g., a stock, bond or real estate). The conventional wisdom posits investors sell more before a capital gains tax hike goes into effect, thereby weighing on returns in the lead-up to the implementation date—before improving afterwards. In contrast, a capital gains tax cut supposedly does the opposite: Returns build higher as people delay selling until the change goes into effect, then worsen afterwards as investors theoretically then sell off more eagerly. Yet history cuts against this thinking, too: Stocks are overwhelmingly positive in the 12 months following either type of change to the capital gains tax rate. (See Exhibit 2.)

Exhibit 2: Capital Gains Tax-Rate Shifts

Source: Tax Policy Center and Global Financial Data, as of 10/27/2017. S&P 500 price returns for the periods indicated.

We aren’t saying taxes have no impact whatsoever, but they are just one of many factors stocks consider. Also keep in mind tax changes don’t happen overnight. They can take a long time to go from campaign proposal to law—and the legislative process can often lead to a watered-down result while sapping surprise power. Take the TCJA. Experts were analyzing Trump’s proposed tax cuts when he was campaigning in December 2015—about 8 months before he won the Republican presidential nomination, 11 months before he won the presidency and 2 years before the TCJA actually became law. Throughout Trump’s first year in office, lawmakers spent months debating his plan. The House eventually passed its bill in mid-November, with the Senate following suit a couple weeks later. Markets are efficient discounters of widely known information, and surprises tend to move stocks most. Nothing about this process was surprising.

Another factor stocks recognize: Tax changes made today may not be long lasting since laws passed by one party’s narrow majority can be overturned by the other party’s narrow majority a few years later. Given this political development, put yourself in the place of a company executive. The TCJA’s reduction of the corporate tax rate to 21% may encourage you to pursue some long-term investments. Yet a mere three years later, Biden campaigns on raising that rate to 28%. If he wins and has a Democratic Congress, he can make good on his promise, reducing that formerly attractive tax benefit. We aren’t saying that will happen in the coming months—a lot of factors go into the lawmaking process—but if you are an executive making plans, this possible change adds a complication to consider. This uncertainty makes it harder to plan and may sour you on pursuing the investment.

While pundits cheer or fear potential new tax policy, these changes—if implemented—simply create new winners and losers. History illustrates they aren’t a broad net benefit or negative, and we don’t see that changing under a Biden or Trump presidency.

Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

[i] Source: Tax Foundation, as of 09/10/2020.

[ii] Ibid.

[iii] Ibid.