Fisher Investments Urges Patience After a Heated Election Season

Emotions are still running high following Election Day and, as uncertainty persists, Fisher Investments cautions investors against making hasty portfolio decisions.

In our decades of experience counseling investors, we’ve found circumstances that create widespread uncertainty or fear often drive people to make knee-jerk portfolio changes which can significantly hurt their long-term investing returns. Bear markets, polarized elections and global events like 2020’s COVID-19 pandemic are all examples of situations that raise investor anxiety and may lead them to make risky decisions—like selling their stock positions even when their portfolios require long-term growth.

Fisher Investments believes investors who need their portfolios to grow over extended time horizons (such as 10, 20 or 30 years) are best served by keeping an even keel and staying focused on the long-term. If the election, bear market or pandemic made you question your investment strategy, you may benefit from working with an experienced professional who can provide reassurance and help you stick to your financial plan.

Here’s how we think long-term investors should view markets today.

Reframing today’s issues can help you stay disciplined

2020 has been an exceptionally difficult and, in some ways, unprecedented year for everyone, including investors. Never before has a global pandemic prompted widespread government-mandated economic shutdowns, which then led to history’s fastest bear market. Add record job losses, social unrest, natural disasters and a contentious US presidential election to the mix and you have plenty of reasons to doubt the market’s ability to climb higher.

While Fisher Investments acknowledges the reality of today’s challenges, we recommend reframing them within a historical context to remind yourself of capital markets’ resiliency. Doing so may help you avoid making emotionally-driven investment decisions that could hurt your long-term returns.

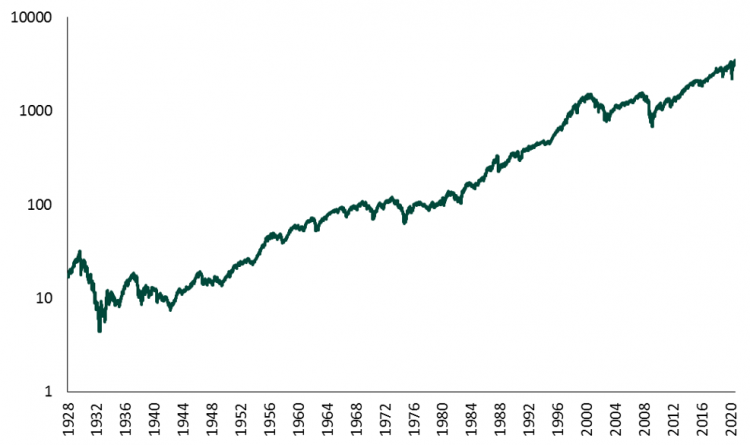

Since the turn of the 20th century, when reliable stock market data became available, the world has endured some truly awful experiences, including The Great Depression, World War II, the Cuban Missile Crisis, the 9/11 terrorist attacks and much more. Yet, despite all these challenges, markets have continued rising over the long term. (Exhibit 1)

Exhibit 1: S&P 500 Price Level, 1928 – 2020, Logarithmic Scale

Of course, we’re not suggesting the rise has been smooth. Even Exhibit 1 shows periods punctuated with volatility, flat growth, market corrections and bear markets. But the long-term pattern is clearly one of generally rising stock market prices—and that’s the key insight for long-term investors.

However, maintaining the long-term perspective is easier said than done when uncertainty strikes. When markets fall, you may be tempted to sell your stocks and shift to cash until things “calm down” and it seems safe to get back in. While this makes sense in theory, it’s incredibly difficult to execute successfully.

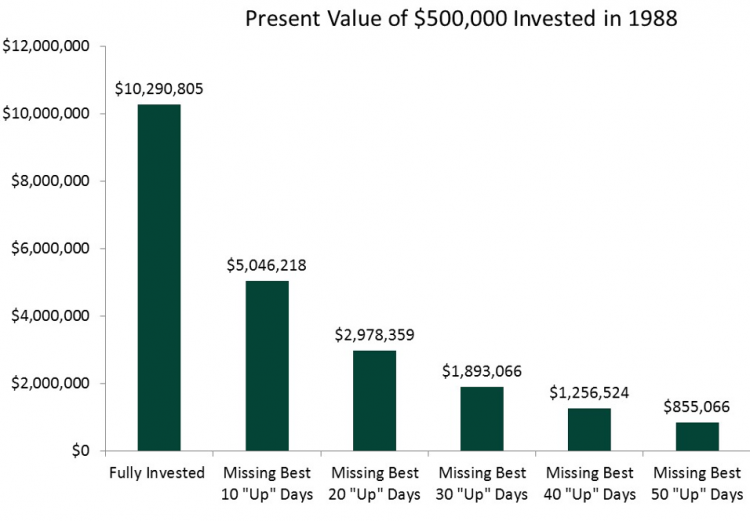

Trying to avoid short-term market declines requires superb market timing—both in your exit from stocks and re-entry. Stocks often rise just as quickly as they fall. If you move to cash but wait too long to re-invest in stocks, you may miss the strong rebound that often follows steep declines. Some of the biggest up days in the market come immediately following a downturn, and missing even a few of these days can have serious negative consequences on your long-term returns.

Exhibit 2 shows what would have happened to a hypothetical portfolio invested from 1988 to 2020, if you missed the best 10, 20, 30, 40 and 50 days in the market. Just missing 10 of the biggest up days cuts the portfolio’s return in half over that timeframe. While it may feel safer to get out during turbulent times, the short-lived comfort may not be worth the long-term cost.

Exhibit 2: It’s Time in the Market—Not Timing the Market—That Matters

How Fisher Investments helps investors stay on track

We recognize investing isn’t easy—especially when going it alone. Uncertainty is always present and continuously challenges investors’ fortitude. Having a dedicated professional who is always there for you may help. Fisher Investments helps clients by providing personalized service, ongoing education and proactive communication during good times and bad.

Every Fisher Investments client works with a dedicated Investment Counselor who knows their personal financial situation and long-term goals. Investment Counselors stay abreast of any changes that may warrant a shift in each client’s long-term plan all while providing the service, education and resources necessary to help clients maintain discipline.

Additionally, Fisher Investments provides clients ongoing education about markets, investing and our investment philosophy through one-on-one conversations; client seminars, webinars and roundtable discussions hosted by experienced members of the firm; in-depth quarterly market reviews and outlooks written by the firm’s Investment Policy Committee; and daily market commentary on the company’s MarketMinder blog section of the fisherinvestments.com website. These services are all aimed at keeping clients informed about the markets and the firm’s views.

Investing is tough and can be emotionally taxing even for seasoned investors. When times get challenging—such as during the COVID-19 pandemic or after a contentious US election—having a trusted adviser who is looking out for your best interest may be the key to your long-term investment success.

Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.