Investing to Secure Your Legacy

If you’re in the fortunate situation of having enough money to comfortably afford your retirement lifestyle, then you may be thinking about building a financial legacy. Maybe you want to leave something behind for your children or other family members, a beloved friend or a favorite charity. Leaving a legacy is an important component of estate planning—the process of determining how your assets are dispersed after you pass away. However, properly balancing your financial needs in retirement with the goal of leaving a legacy means potentially adjusting your investing goals, time horizon and asset allocation. By taking these steps, you can start securing your legacy today.

Importantly, your estate plan shouldn’t jeopardize your financial needs in retirement. Those needs should be your first priority.

Leaving a legacy means not leaving it to chance

The first step is setting a specific goal for your legacy so the outcome isn’t left to chance. Not only does this give your estate plan direction, but it also could affect the investment strategy you’ll need.

Begin by thinking about whom you would like to be the beneficiaries of your legacy. Parents often prioritize their children or other family members. Others want to leave gifts to charitable organizations or an alma mater. There’s no right or wrong answer, but your choice of beneficiaries could influence your investment approach.

Next, consider your intentions for a legacy. Common examples include:

- Distribute as much money as possible.

- Leave a specific dollar amount.

- Give whatever is left from your retirement portfolio after you’re gone.

This is your chance to answer the big questions: who, when and how much. Be specific when you set your goals. Add as much detail as possible. This will help make the following steps much easier. If you want to pass money on to your children, you could specify amounts for each child or split a total amount equally among them. You may also split the amount among family and friends. Depending on the amount, you might even want to create an ongoing gift for future generations by establishing an endowment or scholarship fund.

Setting specific goals is important for your legacy planning because your beneficiaries and your intentions help determine your portfolio’s investment time horizon and optimal asset allocation—essential investing decisions.

Adjust your time horizon

Your investment time horizon is how long you need your assets to last. With typical retirement planning, your time horizon is likely governed by your life span and that of your spouse or partner. But leaving a legacy entails passing assets on to a person or an organization that may use the money for many years after you’re gone. That may mean your investment strategy needs to account for your beneficiaries’ time horizons as well.

Start by looking at your own investment time horizon. One place to begin is the standard life-expectancy tables you can find online; however, tools like these may actually underestimate how long you could live. Remember, these estimates are averages. By definition, that means some will outlive the average and others won’t. If you’re healthy or have a family history of longevity, you could live far past these projections. Therefore, for your own financial well-being, it may be prudent to plan for a longer time horizon to minimize the chance you’ll run out of money in retirement.

After considering your own needs, your investment strategy can focus on your beneficiaries’ investment time horizons. If you plan to leave money to organizations or younger individuals, their investment time horizon likely extends well beyond your own. If your wealth allows you to set up an endowment or scholarship fund, that time horizon may even be perpetual.

In these cases, your portfolio may need to grow well beyond your lifespan. That means conservative, low-growth investments may not be appropriate for your goals and time frame. Rather, your portfolio could benefit from assets with more short-term volatility and higher long-term expected returns to achieve that needed growth.

Adapt your asset allocation to your legacy goals

Fisher Investments believes asset allocation—your portfolio’s mix of stocks, bonds, cash and other securities—is the single greatest contributing factor to portfolio returns over the long run.

If your long-term legacy goal is to leave as much money as possible to your beneficiaries, you may benefit from stocks’ historically higher long-term average returns relative to bonds. While some investors consider a bond-based strategy “safer” than stocks during retirement, the opposite may be true for longer investment time horizons.

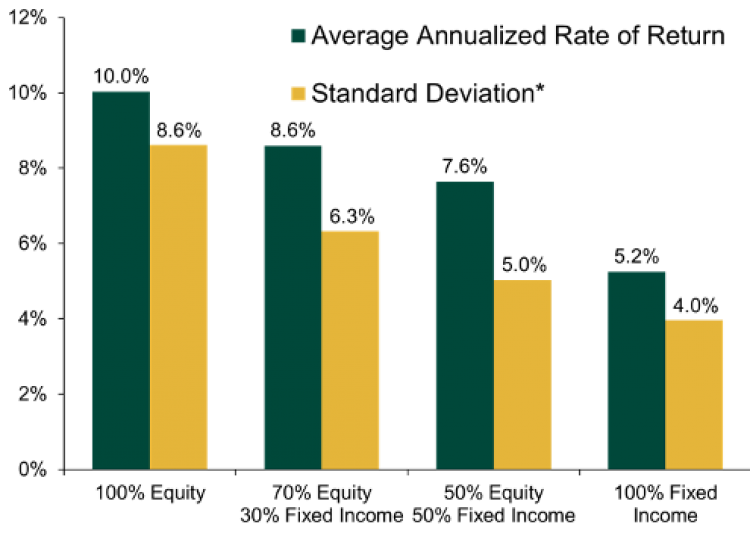

For example, the exhibit below shows the annualized rates of return for portfolios of stocks and bonds over 5-year and 30-year rolling periods. Over the relatively short five-year rolling periods, stocks show higher average annualized returns and higher standard deviation, a common measure of volatility and risk.

However, over 30-year rolling periods—a better approximation of the time horizons that a financial legacy might entail—higher allocations to bonds tend to lead to lower average annualized returns and higher volatility. This means that legacy goals that stretch beyond just a few years might benefit from the growth that higher allocations to stocks could provide.

Exhibit

5-Year Rolling Periods

30-Year Rolling Periods

*Standard deviation represents the degree of fluctuations in the historical returns. The risk measure is applied to 5- and 30-year annualized returns in the above charts.

Source: Global Financial Data, as of 04/14/20. Average rate of return from 12/31/1925 through 12/31/2019. Equity return based on Global Financial Data’s S&P 500 Total Return Index. The S&P 500 Index is a capitalization-weighted, unmanaged index that measures 500 widely held US common stocks of leading companies in leading industries, representative of the broad US equity market. Fixed Income return based on Global Financial Data’s USA 10-year Government Bond Total Return Index.

The bottom line? If you want to leave a legacy, your time horizon and optimal asset allocation may be different than you expect. Holding too many bonds or low-returning securities too early could inhibit your ability to reach your long-term estate-planning goals.

Estate planning and leaving a legacy are about more than setting up a will and hoping for the best. They’re about determining how you want to be remembered, ensuring your family and loved ones are provided for and achieving your charitable goals. By acting now—setting goals, adjusting your investment time horizon and adapting your optimal asset allocation—you’ll give yourself the best chance at securing your financial legacy.

Investing in stock markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. International currency fluctuations may result in a higher or lower investment return. This document constitutes the general views of Fisher Investments and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.