Bruce Thompson was a U.S. Senate aide, assistant secretary of Treasury for legislative affairs, and the director of government relations for Merrill Lynch for 22 years.

Bruce Thompson

Author Archive

-

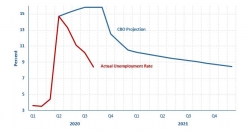

Feb 7, 2026The Congressional Budget Office has released its annual report on the accuracy of its budget projections for fiscal 2025. It is a useful yearly reminder to policymakers that CBO...

Feb 7, 2026The Congressional Budget Office has released its annual report on the accuracy of its budget projections for fiscal 2025. It is a useful yearly reminder to policymakers that CBO... -

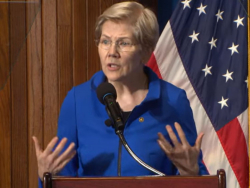

Jan 30, 2026Senator Elizabeth Warren recently gave a speech presenting her version of an economic agenda which she said would help working people. She railed against giant corporations,...

Jan 30, 2026Senator Elizabeth Warren recently gave a speech presenting her version of an economic agenda which she said would help working people. She railed against giant corporations,... -

Jan 13, 2026Congressional Democrats keep saying they are focusing on the affordability crisis, promising that they will soon come up with an agenda to lower costs for working people. What they...

Jan 13, 2026Congressional Democrats keep saying they are focusing on the affordability crisis, promising that they will soon come up with an agenda to lower costs for working people. What they...